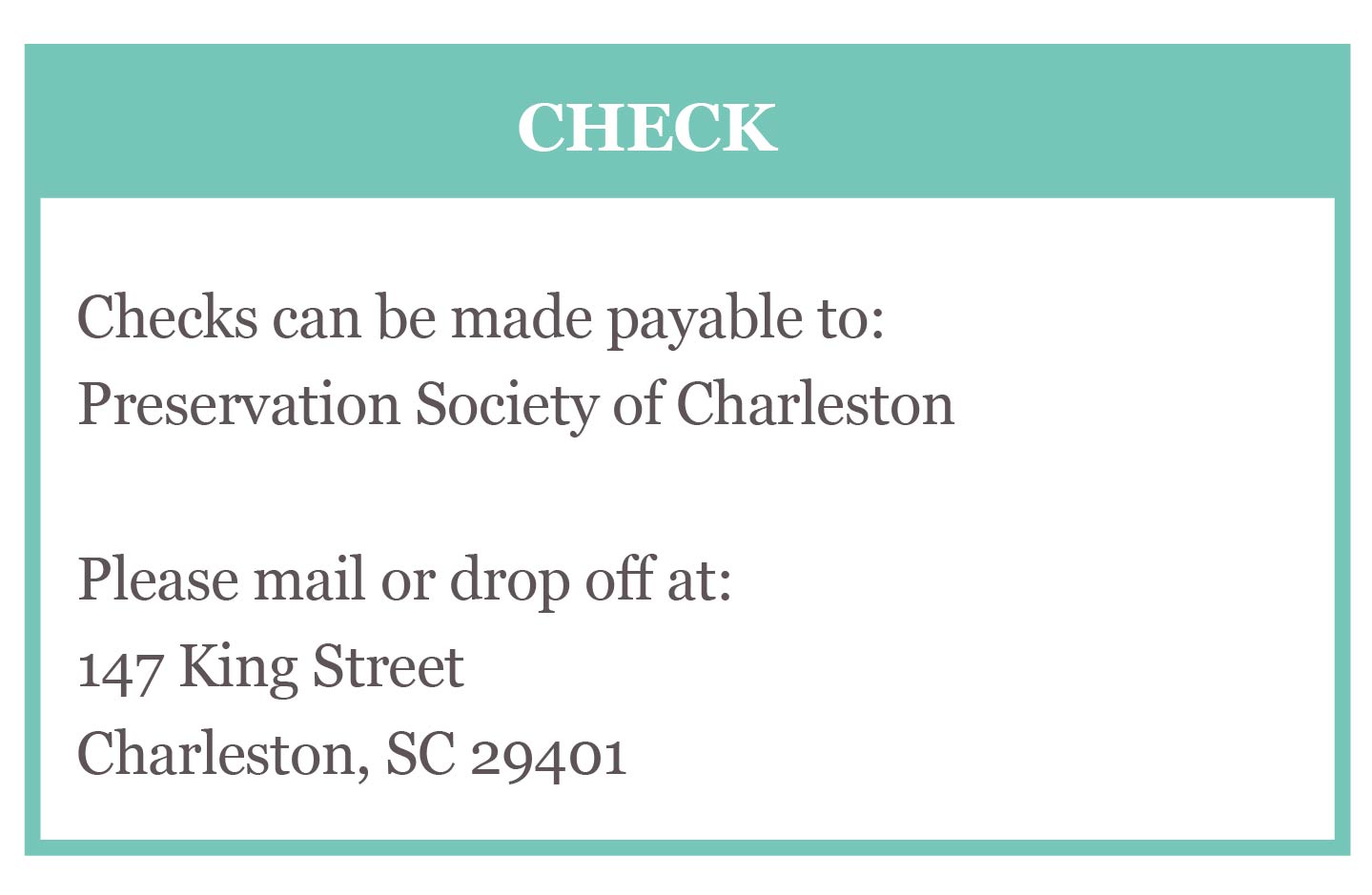

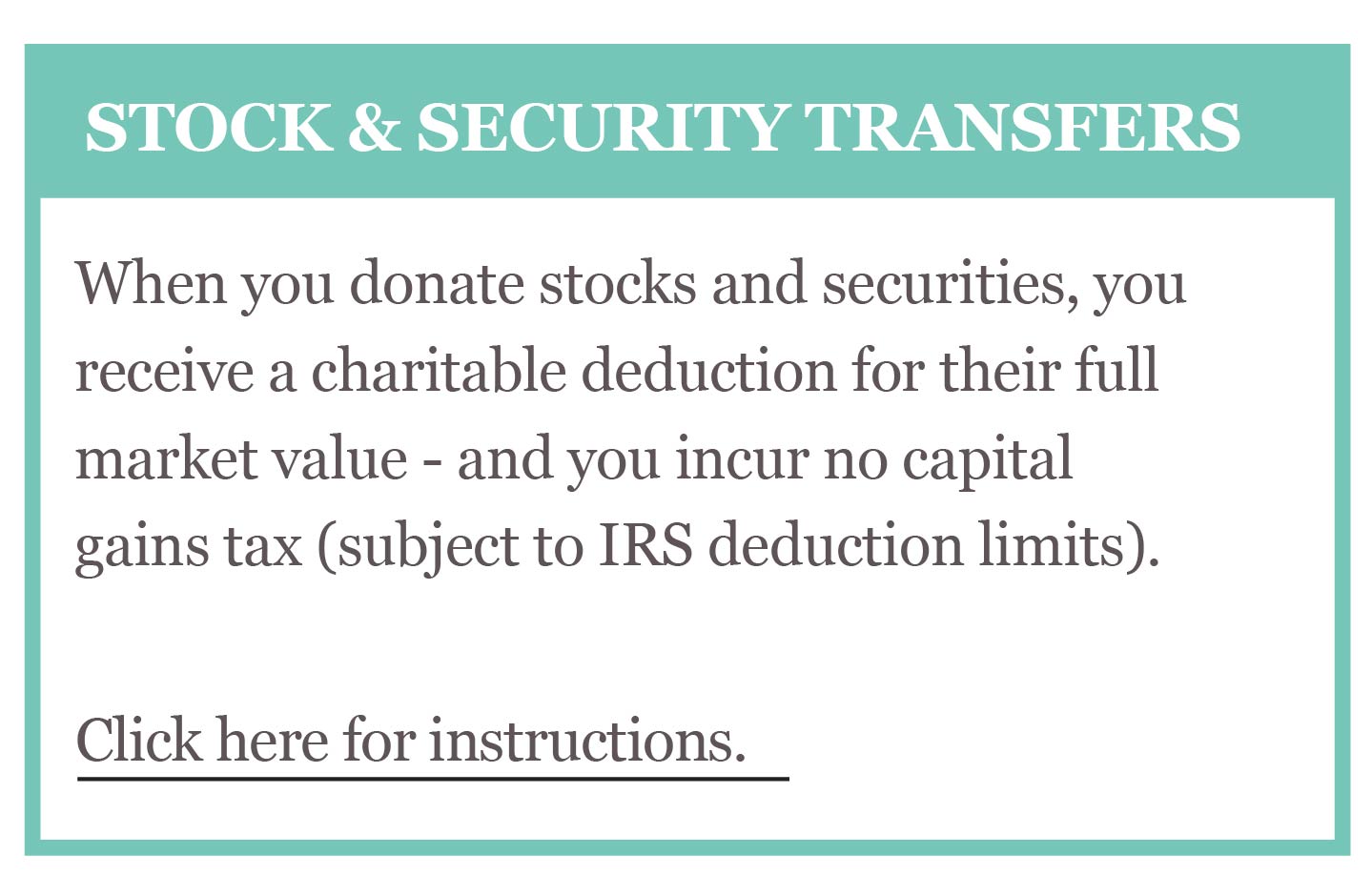

Donate to the Preservation Society of Charleston

The Preservation Society of Charleston is made possible through the generosity of our donors. When you donate to the PSC, your gift contributes to all of our valuable preservation programs, advocacy and outreach efforts, and exciting events and educational opportunities throughout the year. Consider making a donation today to support our mission and goals.

DONATE NOW